The new Medicare cards are coming! With the Equifax security breach in the news, as well as other recent hacks of personal and sensitive information, this news could not come soon enough. Medicare will begin mailing out the new Medicare cards in April 2018.

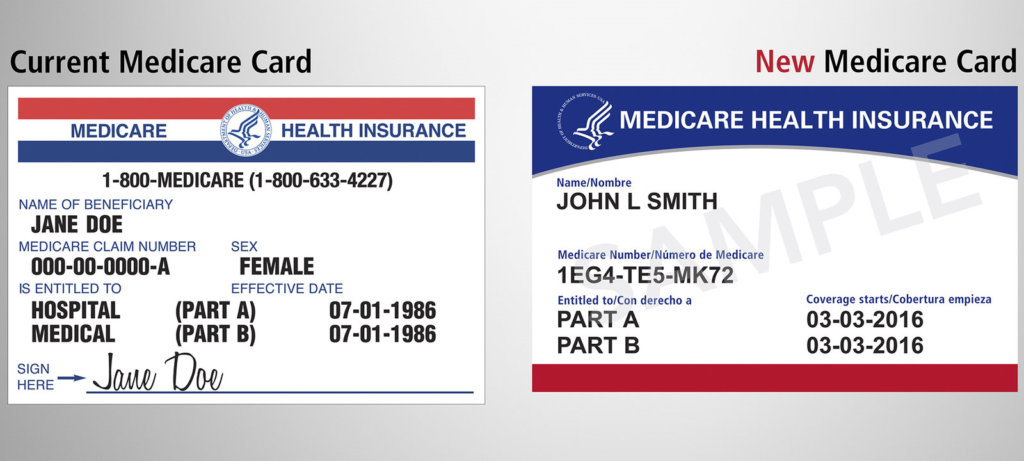

FIRST LOOK! The new Medicare cards will no longer contain your Social Security number. Instead, they will have a random, unique sequence of numbers and letters.

Currently, Medicare cards contain a Social Security number on them with a letter at the end. The letter, by the way, indicates whether you are drawing Social Security yet, and whether your Social Security is based on your work history or that of a spouse, former spouse or deceased spouse. Most Medicare cards contain the Social Security number of the insured person.

In 2015, Congress passed a law requiring Medicare to change the way they identify Medicare beneficiaries on their Medicare cards. It’s a bit of an undertaking with Medicare having to assign all Medicare beneficiaries a new unique number and recreate 60 million Medicare cards. The rollout of the new Medicare cards will take place over a 12-18 month period, and it will begin in April 2018.

“We want to make this process as easy as possible for everybody involved,” said Seema Verma, the administrator of the Centers for Medicare & Medicaid Services, on a conference call Thursday.

Medicare has set up a website specific to the transition, will also be sending out handbooks related to this and has a call center to handle questions specific to the new Medicare cards.

So, what do you, as a Medicare beneficiary, need to know about the new Medicare cards:

- First and foremost, you should not do anything with your current card until you receive the NEW Medicare card. Keep using the current card, then once you receive the new one, replace the “old” card (the one with a Social Security number on it) with the new card (the one with the unique set of random numbers and letters on it).

- Be patient. CMS Head Seema Verma stresses that the rollout will START in April 2018 but it will carry over into 2019. We would expect it will last until late 2019. There has been no indication yet on how they will decide who gets the new cards first or what order they will go in.

- The new cards will be paper, just like the current cards (we know, it doesn’t make sense to us either!). $242 million just doesn’t buy you what it used to, I guess.

- Do not give anyone your current Medicare card or any information from it. Just like everything else that pertains to seniors, there is certain to be scams related to the new Medicare card rollout. To repeat, Medicare will NOT be asking you for your old Medicare card back or any information from it.

- When you receive the new Medicare card, take care to appropriately and effectively destroy the old one. Remember, it has your Social Security number on it. Burning it up may be taking it too far (but it is paper, after all). Whatever you do – cut it, shred it, burn it, flush it – make sure you leave no trace since it has your personal information.

- The new Medicare cards do not affect anything about your actual Medicare coverage. Your benefits will stay the same.

- If you have a Medicare Advantage plan instead of “original” Medicare, you will still get a new Medicare card (even though you don’t have to actually use it). Make sure you keep it in case your Advantage plan cancels you or you decide to go back to regular Medicare in the future.

- If you have a Medicare Supplement (Medigap) plan, you will also receive the new Medicare card but should not need to contact your Medigap company with the new information.

If you have any questions about this transition, or anything else related to Medicare, we are here to help. Feel free to contact us online or call us at 877.506.3378.