OTHER RESOURCES:

I understand Medicare Supplements already. I just want a Medigap quote by email.

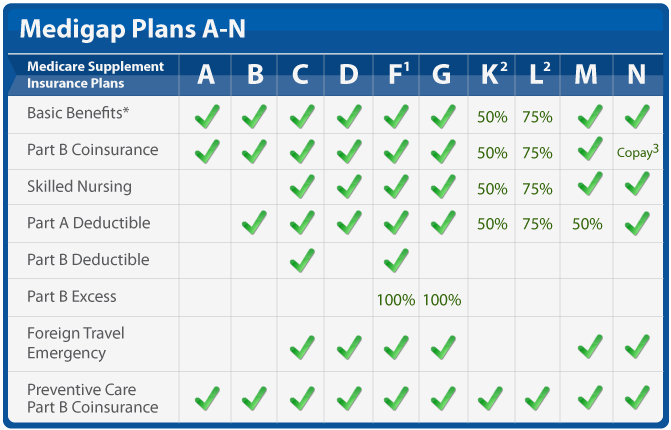

Medigap Coverage Chart

Medigap Plan F

Medigap Plan G

Medigap Plan N

Medigap plans can be a crucial part of any sound financial plan for those on Medicare.

The rising costs associated with healthcare for those on Medicare has made protection against those high costs a necessity. Individuals on Medicare are not immune to those risks; on the contrary, the Federal program has many coverage gaps that leave the insured exposed to the possibility of astronomically high healthcare costs.

In 1992, the Federal Government, recognizing this, created standardized Medicare Supplement plans. Many people use Medicare Supplements (also known as Medigap plans) to eliminate or at the least, reduce the exposure to out-of-pocket costs that are normally encountered under traditional Medicare.

If you are comparing rates from different plans or just turning 65, chances are you have been swamped with information and/or phone calls with sales pitches from various companies. What the individual companies may not tell you is this – Medicare Supplements have been standardized by the Federal Government since 1992. They cover the same things, pay the same way, file claims the same way, and provide the same service, so no matter what pitch you hear or read, the bottom line is, “What’s the bottom line?”

With that in mind, the most essential part of choosing a Medicare Supplement plan is comparing rates for Medigap plans available in your area. You can view a list of those at Medicare.gov (you should this list with your broker as it has not always been updated). The best way to do that is with a online Medicare Supplement rate quote analysis that provides rates for the standardized plans in your zip code (see standardized plans chart below). Then, the choice is simplified – choose a plan, find a company with a competitive rate on that plan and sign up.

We’ve listed and answered below some frequently asked questions about Medicare and supplement insurance:

Let’s start from the beginning – who gets Medicare?

Medicare is available to those who are 65 or older and those who have been on Social Security disability for 25 months. Generally, in nearly all non-disability circumstances, it begins on the first day of the month in which you turn 65.

Medicare is available to those who are 65 or older and those who have been on Social Security disability for 25 months. Generally, in nearly all non-disability circumstances, it begins on the first day of the month in which you turn 65.

What are the Parts of Medicare that I will receive?

As a beneficiary, you will automatically receive Medicare Part A if you have worked 40 quarters in the U.S. You will not have to be a pay a premium for this coverage. Part A covers hospitalization or inpatient coverage. It has a $1364 per benefit period deductible (benefit period = your stay plus 60 days). Then, you pay 20% after that (unless you have a supplement plan which covers the 20%).

You will also be automatically enrolled in Medicare Part B (unless you did not take Social Security at age 62). You do have the option to opt-out of Part B. Part B covers services (i.e. labs, x-rays, outpatient visits, surgeons, etc.) The Part B deductible is currently $185/year (2019). Then, you pay 20% after that (unless you have a Medicare Supplement which covers the 20%).

Parts C (Medicare Advantage) and D (Prescription drug coverage) are optional parts of Medicare.

Read our breakdown on the Parts of Medicare.

Why do I need a Medicare Supplement in addition to Medicare?

Supplement plans are, obviously, a completely voluntary part of health care for those on the Federal Medicare program. Although the majority of people have some sort of complementary plan with their Medicare, there are some who don’t and pay the things that Medicare doesn’t cover out of their own pocket. So, you definitely have that option.

Here is what a Medicare Supplement does do: it reduces your exposure to out-of-pocket costs for things not covered by Medicare.

The formula is pretty simple. WITHOUT a Medicare Supplement, you pay the deductibles. Then, Medicare pays 80% at the doctor’s office and hospital. You pay the remaining 20% with no maximum limits. WITH most Medicare Supplement plans, the Part A deductible and the 20% are covered by the insurer so that you have more predictable out-of-pocket costs.

I understand there are standardized Medigap plans. What do those plans look like?

Below, you will find the standardized plans chart for the Medicare Supplement plans. This information is further explained in the “Choosing a Medigap Policy” booklet that CMS publishes or by calling 877.506.3378.

Read more about what specific plans cover and how they work by clicking the links below. The three most commonly offered and purchased plans are:

How Much Do Medigap Plans Cost?

The cost for Medigap plans is dependent on several variables, including where you live, your age and your gender. Generally speaking, in most areas of the country, you can purchase one of the three common plans for around $100-120/month. But there are definitely some areas in which average costs exceed that amount.

It is crucial to compare the Medigap plans on the basis of what they cost for each different Medigap insurance company premium. Although coverage is standardized, the rates can vary considerably.