By now, you’ve probably heard that Medicare Supplement Plan F (as well as Medicare Supplement Plan C) is being eliminated as of January 1, 2020. If you already have Plan F or C, or are thinking about enrolling in one of them, you should continue reading this!

For millions of Americans, Original Medicare is not enough to cover all their medical expenses. Thus, a vast number of seniors have supplemental coverage by purchasing a Medicare Supplement (Medigap) policy. Medicare Supplement (Medigap) plans are standardized across the board.

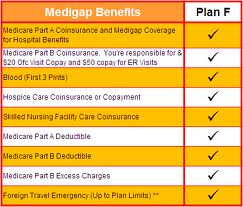

For many years, Plan F has been one of the front runners and best seller of these types of plans. In fact, over half of the people that have a Medigap plan have Plan F. Why? Well, because it is one of the most comprehensive of all the plans – its coverage includes all the deductibles, coinsurance, and copays that Medicare doesn’t cover. In other words, Plan F pays whatever would be your responsibility would be after Original Medicare pays its share. Policyholders of Plan F pay $0 for doctor visits, laboratory tests, surgeries, hospital stays, and more.

Plan F (and C) coverage includes the Medicare Part B deductible. This is called “first dollar coverage” – coverage is immediate, and benefits kick in without having to pay any sort of deductible. However, with this type of coverage, some studies showed (and legislators believed) that policyholders are encouraged to see their healthcare providers more often, since their plan pays for everything. This, it was speculated, put a burden on total Medicare spending.

Therefore, in 2015, Congress passed the Medicare Access and CHIP Reauthorization Act. This legislation prohibited all Medigap plans that cover the Part B deductible, to be sold to new beneficiaries on or after January 1st, 2020. Because of this law, Plans F and C will no longer be available to people turning 65 on or after 1/1/2020. The legislators believe that the existence of higher cost-sharing requirements would be an incentive for individuals to use fewer health care services. Hence, fewer doctor visits would lead to decreased overall Medicare spending.

What does this mean for you, if you already have Plan F or C?

If you are already enrolled in one of these plans, or you have a High Deductible Plan F, you can keep your plan. Enrollment is based on a guaranteed renewable basis; you won’t be denied coverage or cancelled – you will be “grandfathered” in. However, when that occurs, and the pool to new customers closes, the number of existing customers will become smaller. The smaller the number of customers, the less revenue is generated from premiums. In addition, the policyholder base within Plans F and C will be comprised of older individuals, not anyone turning 65. An aging policyholder base will likely lead to more medical expenses, claims etc. As a result, there is a likelihood that insurance companies will raise policyholder premiums more than normal.

If you have Plan F, you may want to reconsider your current plan and current situation. Switching to another plan might be a wise choice. A comparable option would be Plan G, which does not cover the Part B deductible ($185/year). It costs runs on average $25-$40 cheaper per month than Plan F premiums. In reality, Plan G has been the better deal for the last 5-10 years, as Plan F premiums have climbed at a faster rate than ‘G’ premiums.

When you figure out the amount of money you would be saving each month, despite having to pay the $185, you will probably come out ahead, financially. The coverage of that Part B deductible is the only difference between Plans F and G.

A consideration for switching to another plan is that you will have to be subjected to medical underwriting and answer medical questions when you apply. If you have any major health conditions or disorders, you may be declined. In that case, your best option would be to stick with your current plan. There are some states that have an exception to this requirement called the “birthday rule” (Washington, Missouri, California or Oregon give special annual enrollment periods to change plans).

What if I don’t already have Plan F or C, but want to enroll in one of them anyway?

You can still enroll in one of these plans until December 31, 2019. Please pay attention to the fact that you will have to pay the annual Part B deductible, which this year is $185. Also, you may be paying more for your policy in comparison to other insurance companies as explained above when Plan F closes its doors to new customers.

If you are turning 65, you should review pricing and coverage for various options before making your choice. If you are already on Plan F or C, you have less than a year to make your decision to switch or stay where you are. It might be an easy decision for you, or it might be more difficult. A lot can happen before next year regarding your health and finances, so it is prudent to weigh all of your choices from the various insurance companies and make an informed choice.

If you want a list of the plans that are available in your area, you can contact us online so we can send Medigap quotes via email. Or, you can call us at 877.506.3378.