When is the Medicare Open Enrollment Period?

The Medicare Open Enrollment period is terminology that many people often use to refer to the end of the year period during which you can change medical and prescription plans. However, there is definitely some serious confusion about this period and some misuse of the term. This is, at least in part, due to the enormous amount of marketing the insurance companies do during this time of year. So, let’s clear up the Medicare open enrollment period confusion.

Medicare Open Enrollment: When You First Turn 65 or Start Medicare

The actual Medicare open enrollment period is when you first turn 65 or go on Medicare Part B. During this time period, you have open enrollment into a Medigap (Medicare Supplement) plan. This open enrollment period lasts for 6 months starting with the first day of the month you turn 65 (or your Part B effective date if that date is later). During this time, you cannot be made to answer any health questions or undergo any medical underwriting to be approved on a Medigap plan.

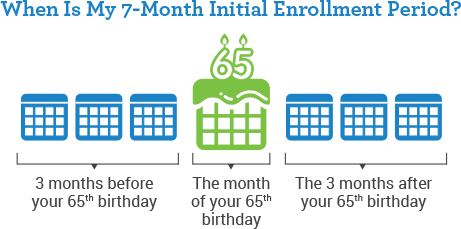

Likewise, when you turn 65 or start on Medicare Part B, you have an initial election period, during which you can select a Part D plan (prescription drug plan) without restriction or penalty. This initial election period lasts for 7 months – the month you turn 65 and three months on either side of that month. During this time, you can select any Part D plan without restriction or penalty.

If you are opting to go with a Medicare Advantage plan, you get the same initial election period as detailed above – 7 months including the month of your 65th birthday and three months on either side of that month.

So, What is the Annual Medicare Enrollment Period?

The period that occurs annually, at the end of each year, is actually the “annual election period” or AEP. This period does not apply at all to Medigap policies (Medicare Supplements). On the contrary, this period only applies to Part D and Part C (Medicare Advantage).

The annual election period runs from October 15 to December 7. During the AEP, you can make changes to your Part D prescription drug plan or your Part C Medicare Advantage plan. Any changes that you make will take effect at the start of the following calendar year.

Many people often mistakenly think that you can also make unrestricted changes to your Medigap plan during that period; however, that is not the case. While you certainly can compare and change your Medigap plan during that period, you do still have to answer medical questions and be approved. It is not, technically, an open enrollment period for Medigap plans though. And, you can compare Medigap plans and change your plan at any time of the year.

How to Prepare for the Medicare Annual Election Period?

If you have either a Part D plan or a Medicare Advantage plan (Part C), you will receive a notice of plan changes for the following year in the mail. This usually comes in late September or early October. It is crucial not to merely disregard this mailing. Some of these plans change drastically each year, and you don’t want to get stuck in a deteriorating plan.

When you receive your notice of plan changes, you should look over it carefully. It should show a side-by-side comparison with the previous year’s benefits. See what changes have been made and decide, based on the plan changes, your satisfaction with your plan, and any changes to your health or finances, whether you want to “shop” for a new plan.

If you do want to shop for a new Part D or Advantage plan, keep in mind that you can only do so during the annual election period, which runs from October 15 to December 7.

Secure Medicare Solutions is a leading, independent Medicare insurance agency. We work with the companies that do Medicare Supplement plans so that you can compare all options in a centralized, unbiased place. We also provide Medigap quotes online by email and can answer any questions that you have. You can reach us at 877.506.3378 or online.